The Commissioner of Valuations wishes to advise that Notices of Valuation are currently being dispatched to property owners. The Notice of Valuation provides the Annual Rental Value (ARV) of your property.

The Notices of Valuation and computations of ARV were done in accordance with the Valuation of Land Act Chap 58:03 which governs the valuation of land. This Act has been amended by: Act No. 17 of 2009, Act No. 5 of 2018, Act No. 21 of 2022, Legal Notice No. 69 of 2023, Act No. 5 of 2023 and Legal Notice No. 212 of 2023.

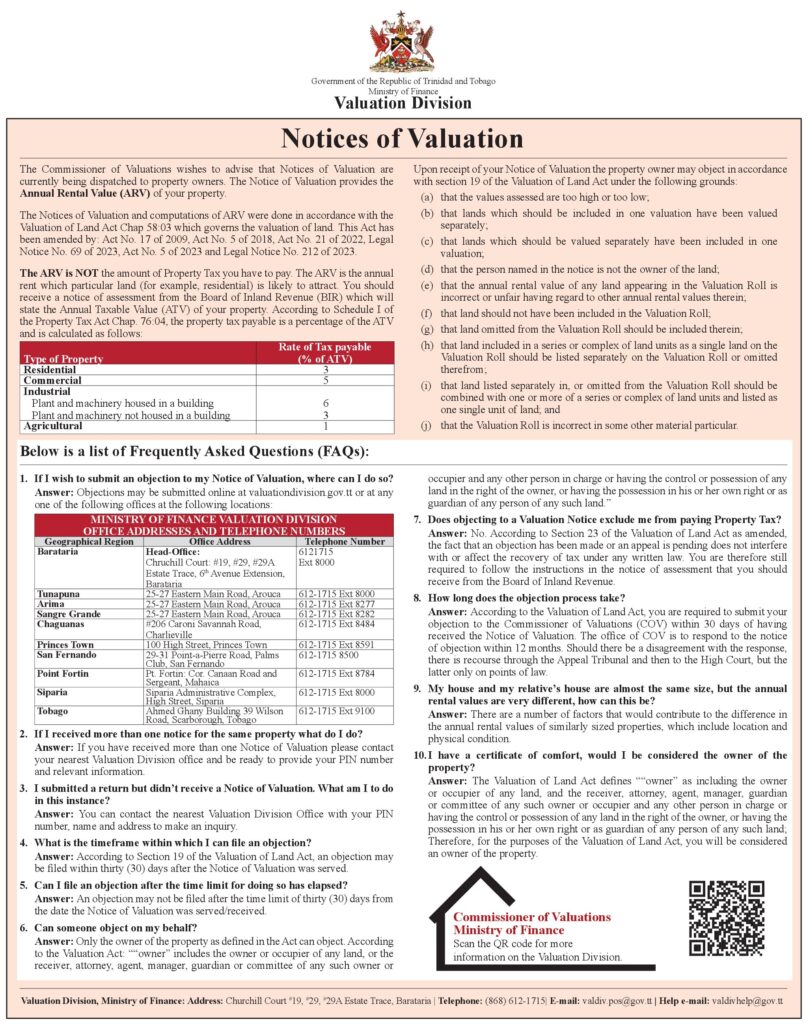

The ARV is NOT the amount of Property Tax you have to pay. The ARV is the annual rent which particular land (for example, residential) is likely to attract. You should receive a notice of assessment from the Board of Inland Revenue (BIR) which will state the Annual Taxable Value (ATV) of your property. According to Schedule I of the Property Tax Act Chap. 76:04, the property tax payable is a percentage of the ATV

and is calculated as follows: